Visitor Insurance Plan

June 20th, 2011 by Jennifer FrankelAre you planning to travel outside your home country? Whether you plan to travel internationally for a few months or a few years, you may want to consider purchasing a visitor insurance plan. There is nothing like being outside your home country while you get sick or injured, especially if you are unfamiliar with the health care system. Instead, protect yourself and family members by purchasing a visitor insurance plan that will cover you while overseas for doctor visits, hospitalization, emergency medical evacuation, repatriation, prescription medications, etc.

By doing this, you are ensuring that you will be able to seek the treatment in case the unexpected happens. It is important to consider what type of coverage you are looking for – do you want a standalone emergency medical evacuation and repatriation plan, a travel health insurance plan to cover you outside your home country, or a comprehensive annually renewable health insurance plan? By deciding on the type of visitor insurance plan you are looking for, you will be able to narrow down your choices.

Most international policies also provide travel and medical assistance that is invaluable. Before purchasing an insurance plan, make sure that the assistance is 24 hours and check before to see if there is an international number. Whether you need pre-trip health and safety advisories, medical referrals, embassy or consulate referrals, a number of plans offer an array of services. Some plans even assist with translations and interpretations, bail bonds, and lost passport/travel documents! Contact one of our licensed agents to see our our visitor insurance plan can help you!

How Insurance Works

June 17th, 2011 by ahoontrakulOnce you have an insurance policy with International Student Insurance (whether it is the Student Secure plan, the Atlas plan, or the Citizen Secure plan), you can rest assured that you are protected in the event that you get sick or have an accident while traveling or studying abroad.

Whether you go to the doctor or hospital, your provider will expect to be paid for any services and treatments given during your visit. Depending on your provider, your doctor or hospital may accept direct payment from the insurance company, or you may need to pay first and then be reimbursed.

Some insurance plans have a network of doctors and hospitals that are contracted to accept direct payment. This means that your expenses will be paid directly from the insurance company to the doctor or hospital. With the Student Secure, Atlas or Citizen Secure plan there is an optional network you can use called the CMN Network. If you choose to go to an in-network provider, they have agreed to accept direct payment. If you go outside the network, it will be up to the provider on how they want to receive payment.

If you have already paid for the doctor visit or your provider requires you to pay upfront, you will need to file a claim. To do this, you will need to attach your bills, receipts, and a Claimant Statement to show proof of claim. With the Student Secure, Atlas Travel, and Citizen Secure plan, this information can be submitted by email, fax or mail. Once your claim is received and reviewed, you will receive an Explanation of Benefits and reimbursement. Your Explanation of Benefits outlines what medical treatment and services were paid according to the benefits on your insurance plan. This help you know what is covered and to make sure that your insurance plan is working for you!

Emergency Medical Evacuation

June 13th, 2011 by Jennifer FrankelIn today’s environment where individuals travel overseas frequently, it is important to have a plan that includes coverage for emergency medical evacuation.

That brings up the important question, what is emergency medical evacuation?

For those of you who don’t know, emergency medical evacuation – also referred to as “med evac” – provides transportation from one facility to another in the event that medical treatment cannot be provided locally. This benefit can refer to transportation to 1) another facility within your host country, 2) another facility in another country or 3) another facility in your home country. The location is typically decided based on doctor recommendations and most plans will cover the closest facility that is recommended.

Depending on the plan you are interested, benefits may vary in terms of what the plan provides.

One popular option is our Liaison Traveler plan which is designed to offer emergency medical evacuation, repatriation of mortal remains, accidental death and dismemberment, and other incidental coverage and services for persons traveling outside their home country. This plan provides $250,000 for emergency medical evacuation alone! Additionally this plan is offered in various coverage period to allow you to get the coverage you need!

What deductible to pick when buying health insurance

June 11th, 2011 by ahoontrakulWhen purchasing a medical insurance plan, many times you will have the option of choosing what deductible you want to have on your plan. Many people often ask me when buying health insurance “what deductible I should pick?”

The answer will depend on your own personal situation. But first, you need to have a better understanding of what is a deductible. There are some things you should consider when choosing a deductible while purchasing health insurance.

– How much premium can you afford and how much of a deductible can you pay if you incurred claims? Having a deductible is like you sharing financial risk if you get sick or injured with the insurance company, a higher deductible means you are putting more financial risk on yourself because if you get sick you would pay more towards any medical bills upfront. As a benefit for having more upfront financial responsibility of your claims, the cost of your insurance plan will be less.

– Since higher deductibles mean lower premiums, then consider your budget, you can save money now by choosing a higher deductible, but keep in mind what you can afford if something major does happen. You will have to pay your deductible before the insurance makes any payment for claims.

– If you need health insurance to apply for a visa to travel to other countries or to register with an organization like a University, make sure to verify any medical requirements with the organization prior to purchasing. You may have to choose a particular deductible or coverage amounts in order to meet their requirements.

What deductible do to pick when buying health insurance

When you want to buy apurchasing a medical insurance plan, many times you will have the option of choosing what deductible you want to have on your plan. Many people often ask me when buying health insurance “what deductible they I should pick.?”

The answer will depend on your own personal situation. But first, you need to have a better understanding of what is a deductible is. Once you know what a deductible is here There are some things to you should consider when picking choosing a deductible while buying purchasing health insurance.

– How much risk you want to have on yourselfpremium can you afford and how much of a deductable can you pay if you incurred claims?. Having a deductible is like you sharing financial the risk of if you getting get sick or injured with the insurance company, a higher deductible means you are putting more more financial risk on yourself since because if you get sick you would pay more towards your any medical bills upfront. As a reward benefit for having more upfront responsibilityfinancial responsibility sharing more of the riskof your claims, the cost of buying your insurance plan will be less.

– To go along with the first point,Since the higher the deductibles you mean have the lower the premiums, to buy the plan. Sothen consider your budget, you can save money now by choosing a higher deductible, but keep in mind your what you can afford if something major does happen. as well. You will have to pay your deductible before the insurance makes any payment for claims.

– If you need health insurance to apply for a visa to travel to other countries and or to register with an organization like a University, make sure you to checkverify any medical requirements with your the organization prior to purchasing. to know if you mustYou may have to choose a particular deductible or coverage amounts in order to meet their requirements.

Major Medical Insurance for International Students

June 6th, 2011 by Jennifer FrankelMany people ask us, what is major medical insurance?

Simply defined, major medical insurance is designed to cover you in case you need medical care due to severe or prolonged illness or injury. It is an important consideration especially if you will be an international student overseas in a foreign environment. While medical expenses may not be that expensive in your home country, you may find that medical care in other countries can be much more expensive. For example, international students in the US can easily rack up thousands of dollars simply from an emergency room visit or overnight stay at the hospital. Because of this, some international students purchase a comprehensive health insurance that has a high coverage maximum that will cover you in case of a medical injury or illness.

Another consideration that you may not have thought of is what happens if something does happen while you are overseas long-term? When some students go abroad, they may purchase a short-term plan designed to cover new illnesses and injuries during coverage. These plans are generally renewable up to a limited number of years. However, what happens if you graduate and continue in the US on OPT? Or, what happens if you stay for a long period of time and you can no longer renew your plan? In the United States, for example, it can be quite difficult to get coverage that immediately covers an ongoing pre-existing conditions (for those of you not familiar with the insurance jargon, pre-existing condition is defined as a condition that you had prior to obtaining your current insurance plan). By having a plan that can be renewed year after year, this means that you can continue coverage with the same benefits even as your circumstances change.

Because of these reasons, among many others, major medical insurance for international students is an important consideration. With the Citizen Secure plan, for example, this plan provides comprehensive coverage up to $5 million per person, per lifetime. Additionally, this plan can be annually renewed year after year so you can keep the plan whether you are in school, on OPT, or even on a work visa. This plan has been specifically designed as major medical insurance for international students and as such provides 24-hour travel and medical assistance, translation services, and worldwide coverage including in your home country.

Contact one of our license agents for more information on which plan is right for you!

What’s the difference between insurance deductible, coinsurance, and copay?

June 4th, 2011 by ahoontrakulMany people are confused about the differences between an insurance deductible, co-pay, and coinsurance. What are they and how do they differ from each other?

In short, all three represent the portion of the medical bill that you are responsible for in case you get sick or injured – otherwise known as out-of-pocket expenses. However, there are some very unique differences between each one, and we are here to help guide you and understand what each word means in detail.

Deductible

A deductible is usually a fix dollar amount that you have to pay out of your own pocket before the insurance will cover the remaining eligible expenses. Depending on the insurance plan, the deductible can range from $0 all the way up to thousands of dollars. It can also be paid per sickness/injury (per condition) or per certificate period.

As a rule of thumb, the higher the deductible the lower the premium (price to buy the plan), and vice versa – but always be sure to choose the deductible that is appropriate for your circumstances when purchasing an insurance policy.

Coinsurance

Coinsurance is usually a percentage, and represents the percentage cost that you will need to pay and the insurance plan will pay towards your eligible medical expenses. Some common coinsurance examples include: 100%, 80/20, 90/10 and 50/50 – so if you have 80/20 coinsurance on your insurance plan, it means that the insurance company will cover 80% of your medical cost and you are responsible for paying the other 20% yourself. A deductible is commonly used together with coinsurance. In this case you would pay the deductible amount first and after you would have the left over coinsurance amount.

Copay (copayment)

Copays are similar to deductibles, and that it is usually a fixed amount of money you have to pay each time you need to use your insurance plan. Unlike deductibles, copays tend to be smaller dollar amounts and are applied on a per visit basis so that you would have to pay it each visit.

Learn more about our Student Health Advantage with small co-paysWith most insurance plans, you will typically see some combination of deductible, coinsurance and copayments – or in some cases your plan may not have any of them. It will very much depend on your specific insurance plan so be sure to check the policy details so you know what your out-of-pocket payments will be. For more information about insurance terms, and to help guide you further please visit our insurance explained section where we delve into all areas of insurance to help you understand insurance plans more!

Some plans that could be a good fit for your needs if you are a student:

Student Secure Student Health Learn more Learn more Some plans that could be a good fit for your needs if you are a traveler:

Atlas Travel Patriot Travel Learn more Learn more You can also contact us to suggest a plan for you based on your needs.

Chinese International Students Hit Overseas Enrollment Record

May 30th, 2011 by Jennifer FrankelChinese international students have hit the highest record yet at 1.27 million students studying overseas at foreign universities. Not only was this the largest amount of international students that China has had historically, but these statistics outnumber any other countries sending students internationally.

The majority of these international students study in 10 primary countries; in fact according to the Ministry of Education, 90% of these Chinese international students study in Germany, Russia, Canada, South Korea, Australia, Japan, Singapore, France, the United Kingdom and the United States.

Many trace this rise in higher level education overseas to the economic boom in China. Now, many middle class families can afford to send their children overseas to attend foreign universities. According to the BBC, in 2010 most of the 284,000 Chinese international students financed their education privately. In fact, they have found that 93% of these students are self-funded.

If you are a Chinese international student planning to attend a foreign university, you may consider purchasing an international student insurance plan. We recommend that you look into the current health system of your host country to determine whether you will have access to doctor visits, hospitalization, prescription medication, etc. Many students purchase a private international student insurance plan that will cover you as a Chinese studying outside your home country. These international student insurance plans are designed to cover you while you are overseas in the event the unexpected happens.

Tips for learning a new language

May 27th, 2011 by ahoontrakulLearning a new language is a goal that many people have. Whether or not you are an international student, it’s never too early or too late to start learning a new language. Below are some tips to improve your foreign language studies:

- Clearly define the level of fluency you want to achieve – Before you begin studying a new language, you need to clearly define a goal for yourself on how fluent you want to be in your new language. Do you want to just know the basics? Do you want to have a grasp on basic conversation? Do you want to be fluent? Or, do you want to use your newly acquired language for business?

- Setting aside time everyday – Once you have committed to learning a new language, you should set aside sometime everyday to study. Especially with new languages, every moment you are not using it is a moment you are forgetting it.

- Anytime study – Aside from your scheduled study time that you have set up for yourself, make a habit to fit in small amounts of study time if you have some free time on your hands. A good time to do this is when you are commuting by car, train, or bus. Some other ideas include watching TV or movies in the foreign language, listening to music, or even watch music videos.

- Start with a good foundation – While I’m a huge advocate for learning a new language through immersion process, it pays to start with a good understanding of the grammar. Be sure not to pick up incorrect speech which may be harder to fix once you have incorporated it into your understanding of the language.

- Find friends who can practice with you and use it in daily situations.

- Join a language exchange community website – If you are having a hard time finding friends to practice with, try joining a language exchange website. You can practice your new language in exchange for helping the other person learning your language – all online!

- Don’t be afraid to make mistakes – It’s normal to be a little nervous and you might find it a little awkward but if you become too afraid to speak than your language will not improve.

- Start now, don’t wait – As they say, you’ll never get anything done if you procrastinate.

- Study Abroad! – Personally, I think there is no better way to learn a language than to put yourself in an environment where everyone around you only speaks the language you’re trying to learn. A good way to do this is of course to study abroad.

Graduate School Applications Increase for International Students

May 23rd, 2011 by Jennifer FrankelAre you an international student interested in studying in the United States? You are not alone – many students dream of studying overseas with the hopes that they will have an international education that will make them competitive in today’s difficult job market! Current statistics are out and reveal that many more international students this year have applied to graduate programs compared to years prior. In fact, according to current data, there has been a 9% increase in the number of graduate student applicants.

If you are one of these students preparing yourself to enter graduate school in the United States, you will want to purchase an graduate international student insurance that will cover you will outside your home country. Our Student Secure plan has been specifically designed to cover you outside your home country while studying in the US. Coverage is geared to cover you for illness and injuries including for doctor visits, hospitalization, prescription medication, repatriation, emergency medical evacuation, and much more! Our graduation international student insurance plan is designed to cover you in case the unexpected happens providing you with a 24-hour toll-free assistance phone number should you need immediate help.

Most graduate schools recommend that you have an insurance plan in place before arriving to the United States. This is because the health care cost can add up quickly should you need emergency care in the United States. Plan in advance and contact your school to see if they have a graduate international student insurance plan in place. Some schools leave students on their own to purchase private insurance, others have a required plan, and some graduate schools will let students waive their plan if they find a comprehensive insurance plan that will meet their listed guidelines.

Contact our offices today to see if our graduate international student insurance plan will work for you. We have licensed insurance agents standing by to assist you with any questions you have about the best insurance options for you.

New Atlas International Travel Medical Insurance Online Application

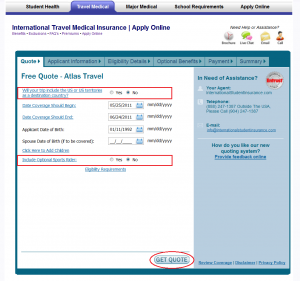

May 20th, 2011 by ahoontrakulYesterday we launched our new Atlas Plan online free quoting/application tool. The new tool has a new design and a few improvements, so I will be going over the steps to completing this application.

The first step of the application is to get a free quote for your Atlas Travel Medical Insurance Plan.

The first question asks “Will your trip include the US or US territories as a destination country?” If you need the insurance to provide coverage for you inside of the US, choose “yes” if not choose “no”. Please keep in mind that if you are a US citizen or US permanent resident you must choose “no” to this question as the plan doesn’t provide coverage inside of the US for US citizen/permanent resident.

Next you will choose when you want your coverage to begin, you can choose to have the plan start in the future or as early as the same day. You cannot choose a date that is in the past. The date coverage should end can be anywhere between 5 days from the start date all the way until 1 year after the start date.

After, you can fill in your date of birth. If you need to include your husband or wife on your insurance plan, fill in their date of birth as well – if not, you can just leave it blank.

If on your trip abroad you will be participating in more adventurous sports such as bungee jumping, scuba diving, rafting, or mountaineering, you should choose to include the optional sports coverage which will give you coverage for these activities as long as it is not part of an intercollegiate, interscholastic, intramural, club, and professional sports or athletic activities or for wage, reward or profit.

Once you have fill out all the information, click on “Get Quote” at the bottom of the page.

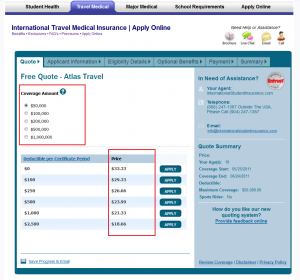

To obtain a quote, click on the “get quote” button and you will be taken to the next page showing you the price for the entire time period you chose in the previous step.

For the coverage amount you can choose from $50,000 up to $1,000,000. You can choose the coverage that you need and the price will automatically update base on your selection. Once you have chose your deductible and coverage, click the “Apply” button right next to the price you want to purchase.

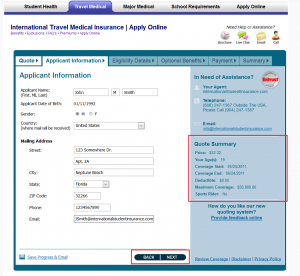

On this page you will simply fill out some information about yourself and your contact information. Your mailing address should be the address where we can reach you. Please be sure to fill out an email that you check regularly as this will be the primary way we will contact you about your policy including your documents and any other requests.

You might notice on the right hand side of the page that you can review the summary of your application so far.

Again, when you have filled out all the blanks click on “next”.

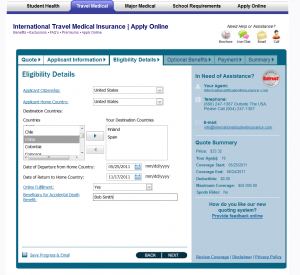

Here you will select your citizenship and your home country just in case your home country is the different than your citizenship.

For the destination countries, choose the country(ies) that you will be traveling to by clicking on the country and then the arrow pointing to the right.

In the “Online Fulfillment Option” by choosing “Yes” you will receive your insurance documents electronically immediately after you complete the application. If you choose “No” you will get the documents physically email to you instead.

The beneficiary for accidental death benefit is the person you’d like to receive the monetary payout in case you pass away. This person can be anyone you want, usually it is a family member.

In this page you are asked again if you want to add the optional sport rider. Again, if you will not need it leave it blank and click next.

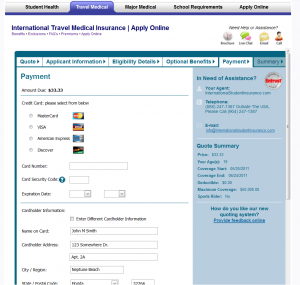

Congratulations, once you’ve reach this point you are almost done with the application. On this page you just need to confirm the price of the plan and include your payment information. You can use a credit, debit or bank card as long as they are MasterCard, American Express, Discover or Visa. Please keep in mind that “Visa Electron” is not accepted.

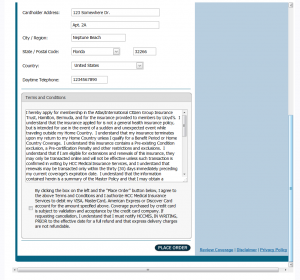

Once you have fill out all the information, read through the terms and conditions and click the check box if you agree then hit the “Place Order” button to submit your application!