International Students in the US

December 14th, 2012 by Bryanna Davis The year is almost to an end and the latest “Open Doors” report from the Institute of International Education(IIE) is in. The number of international students enrolling in colleges and universities within the United States continues to rise, this year brought 764,495 total, a 5.7 percent increase from last year, and a new record high. The trend of the leading country of origin continues to be China, giving Chinese students this title for the sixth consecutive year. Following in the lead is India, South Korea, Saudi Arabia and Canada.

The year is almost to an end and the latest “Open Doors” report from the Institute of International Education(IIE) is in. The number of international students enrolling in colleges and universities within the United States continues to rise, this year brought 764,495 total, a 5.7 percent increase from last year, and a new record high. The trend of the leading country of origin continues to be China, giving Chinese students this title for the sixth consecutive year. Following in the lead is India, South Korea, Saudi Arabia and Canada.

Where were these students headed? The top five states to host international students this past year were California (102,789), New York (82,436), Texas (61,511), Massachusetts (41,258) and Illinois (35,920). A few of the top US schools to host international students were the University of Southern California (9,269), the University of Illinois – Urbana – Champaign (8,997), New York University (8,660), Purdue University-Main Campus (8,563) and Columbia University (8,024).

Almost a quarter of the international students in the US studied business and management (166,733). The second most popular field of study was engineering (141,285) followed by math and computer science (71,364).

Of course the “Open Doors” report does not only track international students in the US. The number of US students studying abroad is also recorded and has recently increased by 1.3 percent. The latest results show that there were 273,996 US students who studied abroad for academic credit, the majority (58.1%) being short-term. A few of the top destination countries were the United Kingdom, Italy, Spain, France and China.

IIE has conducted research on international student trends both in and out of the US since 1919, in 1954 these findings became known as the “Open Doors” report.

International Business photo courtesy of Shutterstock

Renew your Insurance Plan for the New Year

December 7th, 2012 by Bryanna Davis With the New Year and semester right around the corner, many students and scholars will need to renew or extend their international insurance plan to ensure they have the coverage that their school requires. Luckily, those with the Student Secure plan or Atlas Travel plan can renew their plan in a matter of minutes online. If you need to renew your insurance plan for the New Year, follow the simple steps below and enjoy your holiday season knowing that you have the coverage you need!

With the New Year and semester right around the corner, many students and scholars will need to renew or extend their international insurance plan to ensure they have the coverage that their school requires. Luckily, those with the Student Secure plan or Atlas Travel plan can renew their plan in a matter of minutes online. If you need to renew your insurance plan for the New Year, follow the simple steps below and enjoy your holiday season knowing that you have the coverage you need!

- You can start this process in the Student Zone. To log in simply enter your certificate ID number and date of birth or password. Those who are unsure what their ID number is can always contact us for assistance.

- Once logged in, plans that are able to be extended or renewed will populate the option to “Extend Coverage.” Simply select this option and decide if you will be making a single payment or monthly payments. From there, the extension zone will appear and the new plan termination date can be selected. Before completing the extension or renewal of your insurance plan for the New Year there will be an option to review payment information, if the dates and prices are on par with the coverage needed, the next step is to enter in the necessary billing information and click “Proceed to Payment Screen.”

- Once the extension or renewal has been successfully completed you can view your plan extension endorsement which shows the new coverage information.

Students who need a new school insurance waiver or compliance form completed after extending their plan are able to contact us to have the necessary documents completed and sent to their school, or to answer any questions you may have.

6 Month Pre-existing Condition Coverage

November 30th, 2012 by Bryanna Davis As an international student on a F1 visa you are not required by the federal government to obtain health insurance. However, many schools have certain insurance requirements in place that you as an international student will need to abide by. One popular benefit that schools request students to include in their international insurance plan is pre-existing condition coverage after only a 6 month waiting period.

As an international student on a F1 visa you are not required by the federal government to obtain health insurance. However, many schools have certain insurance requirements in place that you as an international student will need to abide by. One popular benefit that schools request students to include in their international insurance plan is pre-existing condition coverage after only a 6 month waiting period.

A pre-existing condition is any illness or injury that displayed symptoms, or that you were treated for, prior to your plan’s effective date. Some insurance plans will exclude these conditions from being covered or require that the student has been on the plan for a certain time period before coverage for those conditions is included.

When a school requires you to find an insurance plan that has pre-existing coverage after a 6 month waiting period, this means that after you have been on a plan for 6 months it needs to cover you for conditions that you had prior to having the plan.

If your school requires that you find an insurance plan that has 6 month pre-existing condition coverage, one plan option is the Student Secure 6 month pre-existing condition plan.

This plan has all of the great benefits of the Student Secure plan like hospitalization, doctor visits, emergency medical evacuation and repatriation of remains. However, you will only have to wait 6 months to have pre-existing conditions covered!

If you are researching international student insurance options that include 6 month pre-existing condition coverage, check out the Student Secure 6 month pre-existing plan. If your school has multiple benefits that you need to meet to waive out of a school plan or to show that you have adequate coverage, contact one of our licensed agents today to find a plan that will include what you need – including 6 month pre-existing condition coverage.

Ankle of male athlete being wrapped photo courtesy of Shutterstock

Which Student Secure Plan Level is Right for You

November 23rd, 2012 by Bryanna Davis You might have done your best with procrastinating when it comes to choosing your international student health insurance plan, but the time has come to make your purchase. Whether you have decided it is necessary for your health or your school has blocked you from enrolling in classes until you have an insurance plan, we are glad that you have started exploring your health insurance options.

You might have done your best with procrastinating when it comes to choosing your international student health insurance plan, but the time has come to make your purchase. Whether you have decided it is necessary for your health or your school has blocked you from enrolling in classes until you have an insurance plan, we are glad that you have started exploring your health insurance options.

Many international students elect to purchase the Student Secure plan but become confused and overwhelmed when trying to pick one of the three levels: Smart, Budget or Select. To help ease the process of deciding which Student Secure plan level is right for you, we have created a guide to assist you when making your decision.

Select: The Select level is the most comprehensive of each of the three Student Secure plan levels. With the Student Secure Select level, students will have a $300,000 policy maximum and benefits like doctor visits, hospitalization, prescription drugs, maternity, mental health, organized sports and emergency medical evacuation. When it comes time to utilize your insurance plan, this level also has the least out of pocket expense.

Budget: If you are trying to decide which Student Secure plan level is right for you and need a plan that will give you great coverage at an affordable price, the Budget level is a popular option. The Student Secure Budget level includes a $250,000 policy maximum, and has many of the great benefits offered in the select level like maternity, organized sports, mental health, emergency medical evacuation and repatriation of remains.

Smart: Although the Smart level is the most basic of the three levels, it still gives student the coverage that they need, but at a reasonable cost. The Smart level gives students up to $200,000 in coverage and benefits include doctor visits, hospitalization, emergency medical evacuation, repatriation of remains and much more. Students looking for a plan to cover them in both an emergency situation and for minor illnesses, like a cold, will want to check out the Smart level.

Another factor to take into consideration when choosing which level of the Student Secure plan is right for you is if your school has certain benefits that you need to have in your plan. Perhaps your school requires you to have maternity coverage, mental health and $300,000 for emergency medical evacuation. In this case the Select level would be best. If your school allows you to choose your plan without having you meet certain restrictions and you are looking for the most economical plan, the Smart level is a popular selection.

If you would like more information on which Student Secure plan level is right for you and will meet your school requiremements please contact our licensed agents today.

Picture of businesswoman photo courtesy of Shutterstock

International Student Insurance Introduced a New Online Application

November 17th, 2012 by ahoontrakulIf you are a student traveling abroad who is in need of a travel medical insurance plan, you may already know that International Student Insurance offers a popular option that provides excellent coverage at a great price – the Atlas Travel plan. Recently we have made the entire online application process even better by introducing our new, easy to navigate application tool.

The new application includes four simple steps:

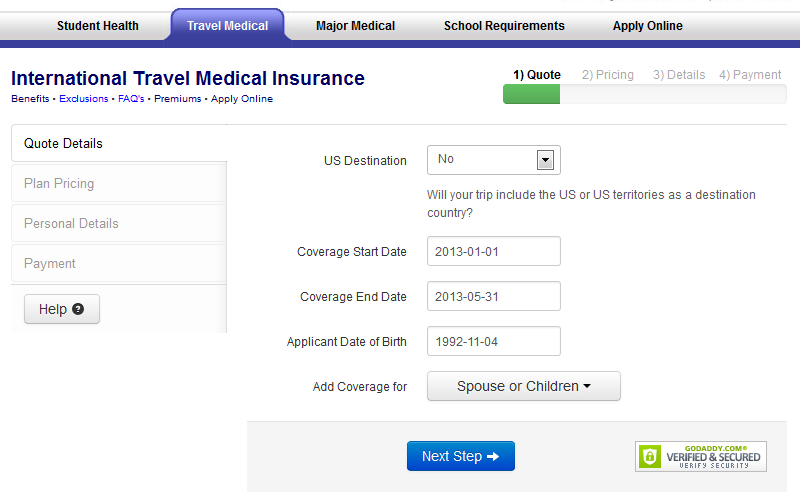

Step 1: Get a free quote

In this step, you will simply need to indicate whether you will need to include the US in your insurance coverage, enter your travel start and end date and the date of birth of everyone who needs the insurance coverage. Once you have done so, click “Next Step.”

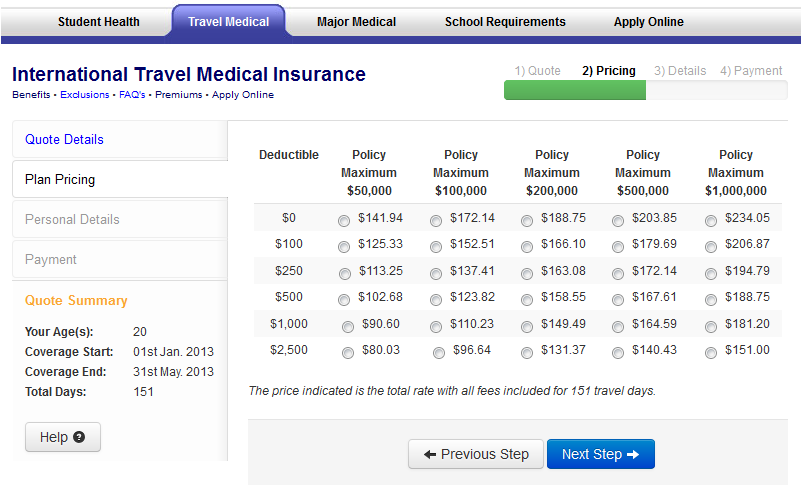

Step 2: Pricing

On this page, you can choose the deductible and coverage amount you would like to include in your plan. You can also see what the price will be for the coverage that you want. Select it by clicking on the bubble next to the price and then click “Next Step.”

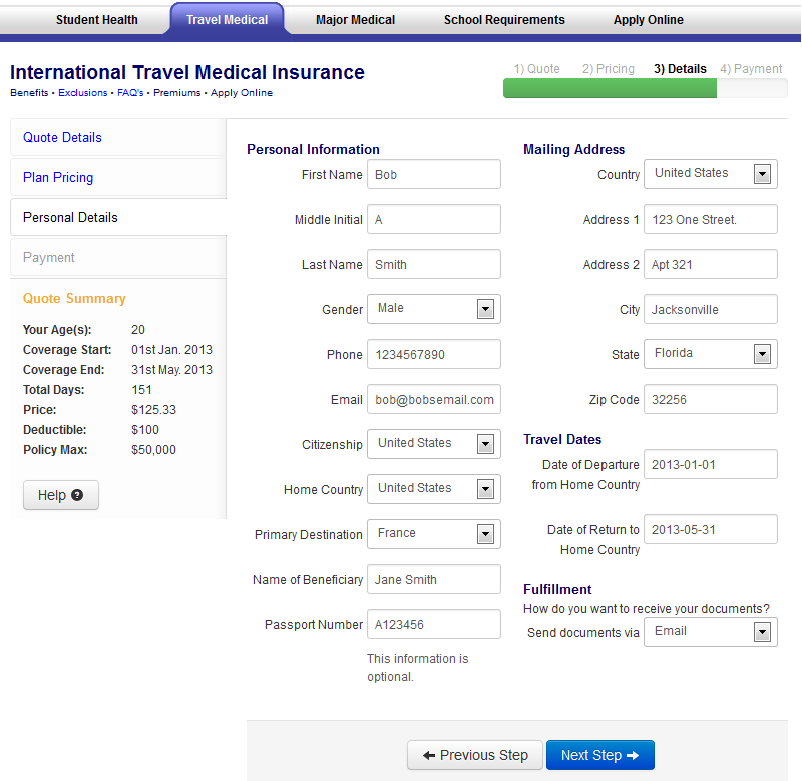

Step 3: Details

Here, you will provide your personal information such as your name, gender, mailing address and beneficiary (person who will receive the death benefit in the event of your accidental death). Again, once you have included all of the necessary information, click “Next Step.”

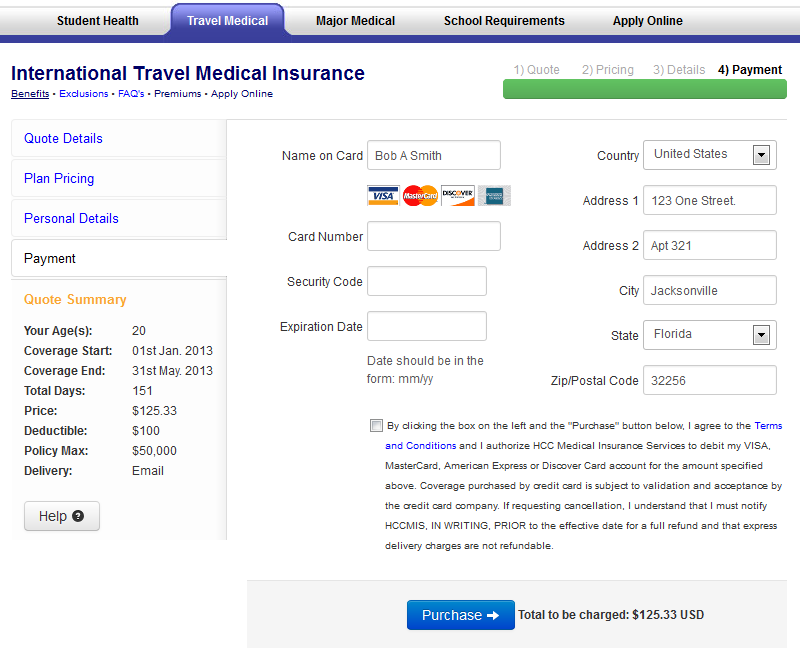

Step 4: Payment

The final step is entering your payment information. To purchase our Atlas Travel Medical plan online, you can make the payment with either a credit or a debit card from Visa, MasterCard, Discover or American Express. Finally, after filling out the information, check the box that you have read and agree with the terms and condition and then click “Purchase.”

That’s it! The application is as easy as 1,2,3…4. After you click on the “Purchase” button, the application will process within a few seconds and you will immediately receive a confirmation email with your receipt and ID card.

If you have any questions about purchasing one of our health insurance plans, please contact our insurance agents today.

International Student Insurance in South Africa

November 9th, 2012 by Bryanna Davis There are over 60,000 international students in South Africa and it’s no secret why there are so many drawn to this county. South Africa is home to both excitement and beauty. There are plenty of mountains for the more adventurous souls to explore and miles of beaches for those who are looking to just relax. Additionally, South Africa is a great place to discover wildlife! Those looking to see the big five: lions, buffalos, rhinos, leopards and elephants will have plenty of chances to do so at one of the many natural wildlife reserves throughout the country.

There are over 60,000 international students in South Africa and it’s no secret why there are so many drawn to this county. South Africa is home to both excitement and beauty. There are plenty of mountains for the more adventurous souls to explore and miles of beaches for those who are looking to just relax. Additionally, South Africa is a great place to discover wildlife! Those looking to see the big five: lions, buffalos, rhinos, leopards and elephants will have plenty of chances to do so at one of the many natural wildlife reserves throughout the country.

Of course there is plenty of nature to be found throughout South Africa, but it also has a more developed side for international students to experience. There are a number of modern cities that provide students with the perfect combination of culture and entertainment to enjoy while pursuing their studies. A few popular cities for students to consider studying abroad in include Cape Town, Johannesburg, Pretoria and Durban.

Those who will be studying as an international student in South Africa must apply and be approved for a study permit and it is better to do this sooner than later. Getting approved for a permit means the student will need to show they have sufficient funds for their studies and that they have adequate international student insurance in South Africa.

One great option when it comes to international student insurance in South Africa is the Atlas Travel plan. This plan provides coverage for doctor visits, hospitalization, emergency medical evacuation, repatriation of remains and organized sports. Students who purchase this plan are also able to choose their own deductible and coverage amount.

If you are in need of international student insurance in South Africa contact one of our licensed agents today for more information.

*A giraffe silhouetted photo courtesy of Shutterstock

Insurance For Parents Visiting Students Oversea

November 3rd, 2012 by ahoontrakul If you are the parent of a student studying abroad, this may be the first time that you are apart from your son or daughter for such a long time. It is natural to worry about their health and well being, many parents even decide to pay a visit overseas to check up on their child. If you are planning to do the same, before leaving, you want to be sure that you have adequate travel medical insurance coverage for your trip.

If you are the parent of a student studying abroad, this may be the first time that you are apart from your son or daughter for such a long time. It is natural to worry about their health and well being, many parents even decide to pay a visit overseas to check up on their child. If you are planning to do the same, before leaving, you want to be sure that you have adequate travel medical insurance coverage for your trip.

Many domestic health insurance plans do not provide coverage while you are overseas, or provide limited coverage. Therefore, before leaving the country, you will want to make sure that your current health insurance plan will cover you internationally. If it does not provide sufficient coverage, you should purchase a short-term health insurance plan. Insurance for parents visiting students oversea is not expensive; you don’t have to spend a fortune to have great coverage.

Our travel medical insurance plan called the Atlas Travel is not just for students studying abroad, anyone traveling outside of their home country is eligible for this plan, so it is a great insurance plan for parents visiting students overseas.

In case you become sick or injured while traveling abroad, the Atlas Travel plan will provide coverage for both doctor visits and hospitalization along with many other benefits. This plan also allows you to choose your coverage anywhere between five days up to one year, so you can fit the plan to your exact travel itinerary.

Regardless of the reason you may want to visit your kids abroad, by making sure that you adequately protect yourself in case of unforeseen events to ensure your trip to see your child is a joyful experience.

Large passenger plane flying picture provided by Shutterstock.comInternational Students at the University of Montana

November 2nd, 2012 by Bryanna Davis The University of Montana has been experiencing a steady growth in the number of international students since they had their first international student in the 1920’s. This year they reached their all-time high of 536 international students coming from 72 various countries around the world, according to the Montana Kaimin.

The University of Montana has been experiencing a steady growth in the number of international students since they had their first international student in the 1920’s. This year they reached their all-time high of 536 international students coming from 72 various countries around the world, according to the Montana Kaimin.

How has the University of Montana maintained and increased their international student population? A portion of the results are due to the institution’s reputation. In the 2010/2011 academic year, Montana Tech of the University of Montana was on the top 40 list of baccalaureate institutions put out by the Carnegie Classification of Institutions of Higher Education.

The other portion of their increase is due to the increased international efforts among the university as a whole. The university uses recruitment methods like offering scholarships to their international prospects and increasing the institution’s presence overseas through means like research projects.

Students who are part of the increasing number of international students at the University of Montana more than likely already know they are required to purchase health insurance and show proof of their coverage each semester. However, what many students don’t know is that they have the option to either purchase the insurance plan through the school, or choose their own individual plan.

For those looking for alternate plan options, one popular choice for international students at the University of Montana is the Student Secure plan. The Student Secure plan comes in three levels: Smart, Budget and Select. Each level has varying benefits and premium costs allowing students to choose the coverage that they want. Smart, Budget and Select will give students coverage for hospitalization, doctor’s visits, repatriation of remains, emergency medical evacuation and multiple other benefits. The Budget and Select levels provide more comprehensive benefits including enhanced mental health, organized sports coverage, dental treatment to alleviate pain and maternity coverage.

International Students at the University of Montana looking for insurance plan options can contact one our licensed agents for more information.

*Portrait of a beautiful young girl standing by a globe against white background photo courtesy of Shutterstock

Insurance for Thanksgiving Break

October 26th, 2012 by Bryanna Davis International students in the US will soon be able to enjoy their Thanksgiving break and have time to relax before the stress of finals begins. During this break university housing will often close, student dining halls give only the bare-minimum options and the campus will resemble a ghost town.

International students in the US will soon be able to enjoy their Thanksgiving break and have time to relax before the stress of finals begins. During this break university housing will often close, student dining halls give only the bare-minimum options and the campus will resemble a ghost town.

Many international students who are studying inside the United States take this time to travel either throughout the US or to a neighboring country like Canada or Mexico. Since Thanksgiving is a time for being thankful and giving back, some may also decide to use this break to volunteer in locations like Costa Rica. Those who are not sure where to go or who don’t want to go alone should do a bit of research on their school campus. Many colleges and universities have group travel and volunteer trips organized for holiday breaks and sometimes even offer school credit for these trips.

International students who will be joining this trend of travel and decide to visit outside the US will want to make sure that their current health insurance plan will cover them in their destination country. If not, they will need to look into purchasing a short-term health insurance plan so they will have insurance for Thanksgiving break.

One international insurance plan that students often purchase for school breaks is the Atlas Travel plan. It can be purchased for a minimum of 5 days up to 364 days meaning that students going on a short trip outside their home country are able to purchase insurance for Thanksgiving break for the exact number of days that they need.

The Atlas Travel plan allows students to choose their coverage amount and deductible and provides coverage for emergency medical evacuation, doctor visits, hospitalization, extreme sports and repatriation of remains.

Those who would like more information on insurance for Thanksgiving break can contact one of our licensed agents today.

*Group of happy, surprised teens photo courtesy of Shutterstock