Does International Student Health Insurance Cover Everything?

June 30th, 2016 by Bryanna Davis Health insurance can provide peace of mind against high medical bills when studying outside your home country – especially while in the US. However, not all insurance plans are the same, and as a buyer it’s important that you research the plan you’re considering and understand what it will cover before an injury or illness strikes.

Health insurance can provide peace of mind against high medical bills when studying outside your home country – especially while in the US. However, not all insurance plans are the same, and as a buyer it’s important that you research the plan you’re considering and understand what it will cover before an injury or illness strikes.

One common question that we receive is: “Does international student health insurance cover everything?” and the answer is a simple one: no. Every health insurance plan will have items that are not covered on the plan, also known as exclusions. Although each plan will have exclusions, this doesn’t mean that you need to take a gamble when it comes to having health insurance, but it does mean that it’s imperative for you to check out both the benefits (items that are covered on the plan) and the exclusions of the plan that you’re interested in.

Why Do Plans Have Exclusions?

Insurance plans have exclusions in order to contain costs, and keep the annual premium at a reasonable level. If a plan covered everything, without any limitation, the cost of insurance would be so high, and more than likely not offer you much financial relief compared to your actual medical bills. If you have certain benefits that you want included in your plan then it’s important to look for those specific items to be covered in the plan you buy.

One important thing to always remember, although you might not find a plan that covers “everything,” it is possible to find a plan that covers everything you need.

What Benefits Are Often Excluded?

Each insurance plan is unique, so the key is to explore the exclusions of every plan you’re considering. To give you an idea of the most common exclusions, let’s take a look at two plan types that most students would be looking at: an International Student Health plan and an International Travel Medical plan.

International Travel Medical

International Travel Medical plans don’t require the purchaser to be a student as they’re designed to cover individuals who need short-term coverage outside their home country. Because of this, these plans do not typically include some of the more comprehensive benefits that International Student Health Insurance plans include. Common exclusions on an International Travel Medical plan often include mental health, maternity, pre-existing conditions, wellness (including vision and dental), organized sports, elective surgery, drug and alcohol abuse, injuries from drug and alcohol abuse, congenital illnesses, STD’s and self inflicted injury.

International Student Health Insurance

International Student Health Insurance plans are designed to meet the needs of international students and scholars like you. Because of this, there are specific coverage items that you can count on a majority of international student plans having- and excluding. Just like on a Travel Medical plan you can still expect to find common exclusions like wellness, elective surgery, drug and alcohol abuse, injuries from drug and alcohol abuse, congenital illnesses, STD’s and self inflicted injury.

Although student plans can be comprehensive and provide coverage for items like maternity, mental health, organized sports and pre-existing conditions, you will find that some conditions, although covered, will require you to fulfill a waiting period before they’re able to be treated. For example, if the plan under consideration has a six month waiting period for pre-existing conditions then you will need to be on the plan for six months before you’re able to have coverage for your pre-existing condition. Benefits that often have a waiting period (if included in the plan) are maternity, mental health, wellness, and pre-existing conditions.

What Benefits Do I Need?

Every international student will have varying needs when it comes to specific benefits but there are a few key items that your school (or your visa) might require you to have. The first step is to check with your school and see what requirements they want you to meet with your plan (if any).

If your school doesn’t require you to have a plan or if they only require you to have basic coverage, keep in mind that it’s still important to find a plan that will provide you with the protection you need- beyond your school’s checklist. Sometimes the school-required coverage isn’t enough as an international student or depending on your personal situation. For example, if you’ll need treatment for a medical condition that you had prior to buying a health insurance plan, it’s important to find a plan that includes coverage for pre-existing conditions, and that you notate any waiting periods related to the plan’s pre-existing condition coverage.

If your school requires you to find a plan that will meet a long list of requirements, keep in mind that you also need to make sure the plan you find will include the coverage you need. For your own protection, international students, scholars and travelers need to have coverage for a few key items- even if your school or visa doesn’t require you to:

- Outpatient and Inpatient Medical Coverage

- Emergency Medical Evacuation

- Repatriation of Remains

If you need certain items included in a plan, whether to meet a certain requirement, or to simply give you the coverage you need, it is possible to find a plan that is designed specifically with student needs in mind, like the Student Secure plan.

What Else Should I Know About Coverage?

When reviewing a plan you might find that some plans do appear to include everything. However, upon closer inspection you will discover that it has internal caps. Because of this, not only should you be aware of and look into the exclusions on a plan, but it’s also important to know about internal caps and if any benefits of the plan you’re considering have them. Although a plan might have a high overall coverage amount listed and cover numerous items, the more you dive into the plan details you may find that it will only cover certain items up to a certain amount or for a specific number of days- this is an internal cap. Many plans have internal caps, but it’s important to know what international caps the plan you’re considering has and ensure that it isn’t too restrictive so you can still receive coverage if the need does arise.

High School Year Abroad – Do I Need Special Coverage?

May 17th, 2016 by Ross Mason

The popularity of international high school programs is increasing as students and parents are looking for an international education at a much earlier age. In the USA alone, there are an estimated 73,000 international high school students studying full-time and this number has tripled in the last 10 years. When you factor in other country destinations such as the UK, Ireland and Australia, for example, the trends are clearly showing a very strong demand for secondary education programs abroad.

While the number of programs and providers are increasing, there is very little written about what you need to consider in terms of your insurance coverage when undertaking a high school year abroad. With this post, we will cover the core topics to make sure you have the most appropriate and comprehensive insurance coverage possible.

Healthcare System

When considering your healthcare options, you first need to understand the healthcare system in the country you will be studying in. You will want to find out if there is a nationalized healthcare system and decide whether you will need to purchase private health insurance.

If there is a national healthcare system, in many cases you might be able to join or pay into that system to get basic healthcare. While this might sound like a great option, you will also need to consider the level of care you will receive under the system and whether there are any waiting periods before your healthcare begins.

Many nationalized healthcare systems offer fantastic, world-class care – however, there could be longer waiting periods to seek treatment (if it is not an emergency situation), and there is typically no coverage for travel-related benefits such as evacuation, reunion, and trip interruption (we will talk more about those benefits further in this post). There is also the possibility that you may have a waiting period – anywhere from 3 to 12 months – to join a nationalized healthcare system. Either way, you might want to look at extra or supplemental health insurance which would allow you to obtain immediate private medical care (if needed) and the optional benefits that will not be present through a nationalized system.

Of course, if there is no nationalized healthcare system, it is imperative that you arrange medical coverage from day 1, and in many cases, your school will require this.

Host-Country or Home-Country Plans?

When looking at insurance options, there are typically a few choices available to you – you can either purchase a plan that is available in your home country to specifically cover you abroad, or you can purchase a plan in your host-country where you will be studying. There are pros and cons to each option, but typically we recommend purchasing an insurance plan that is available in your host country. These plans will be specifically set up to work with the healthcare system in that country, so they will know how to process claims, have a large network of participating providers and your travel assistance will be in the same country and timezone. You might also find that your school will be much happier with this choice too, as they will be more familiar with an insurance plan located in your destination country (and you won’t have to worry about language barriers!).

Benefit Considerations

While standard benefits such as doctor’s visits, hospitalization, prescription medications, etc. are common in most plans, when undertaking a high school program you will want to consider these benefits:

Most of these items are standard in nearly all international insurance plans, so you should be fully covered for the majority of these items. However, if you are relying on a national healthcare system, these are items that would not be covered and would require you to purchase additional insurance to have access to these benefits.

Purchase individual international coverage here

For further details about high school year abroad insurance coverage and options, please do not hesitate to contact us, or visit our high school insurance page for more details.

Capped Benefits: Know the Pitfalls and Dangers!

April 19th, 2016 by Jennifer FrankelWith most insurance plans, there will always be marketing materials such as brochures or a table of benefits that explains the benefits of that particular plan. While this may give you a bird’s eye view of your plan, this is NOT the official policy wording of your policy and you might be surprised to find out that the benefits you thought you had are in fact capped at a lower benefit amount! But why?

In this blog we are going to explore the concept of capped benefits, what they are, and how to spot them so you know what your insurance plan does – and doesn’t – cover.

What Are Capped Benefits?

Health insurance plans may have limitations on benefits, regardless of the overall coverage on your policy. These limits, also known as capped benefits, reduce your coverage by either:

- Putting a maximum dollar amount on a certain benefit (i.e., hospitalization is covered up to $600/day)

- Putting a maximum number of days a benefit is covered (i.e., medicine is covered for 30 days)

In both examples, you could have an insurance plan that covers you up to $500,000, but you would be stuck with a large bill since your policy would stop paying after a certain dollar amount or after a certain period of time.

Example 1. Let’s explore the first scenario where hospitalization is covered up to $600 per day. Hospitalization in the US can cost thousands of dollars every day that you are in the hospital, so if you have an insurance plan that covers only $600 each day, you’d have to pay the remainder of your bill out of pocket.

Example 2. Now, let’s explore the second scenario where you have a condition that requires you to take medication daily. In this scenario, your insurance plan would cover your medication for the first 30 days, but after you would have to pay the full cost of your prescriptions. This may break the bank as some prescriptions can cost hundreds or even thousands of dollars.

In either example, however, it’s important to know how your plan works so that you can budget appropriately! Many international students look for the most affordable plan, but these plans can have these capped benefits. If you need to use the plan, you may find that it wasn’t very economical after all -especially after paying for both the insurance and the portion of the medical bills not covered. Typically, if you pay a little more, you can find a plan without these caps.

But how do you know if your plan has capped benefits?

How To Spot Capped Benefits

As you can imagine, capped benefits can increase the amount you pay out of pocket, and with some insurance plans these limits are hidden! Oftentimes insurance companies provide a summary of benefits in an easy-to-read table that details what is covered on your plan, and they might have a great brochure that summarizes coverage. It’s important that you know that this is NOT the policy wording, and that there may be key pieces of information that isn’t explained in the table or marketing material.

While many insurance companies include this information in their materials so that the consumer knows what they are buying – not all companies do this! To prevent any unwanted surprises, along with large medical bills, it’s important that BEFORE you purchase the plan you ask the insurance company for your policy wording. There are many ways to refer to this document but the most common are:

- Master Policy

- Description of Coverage

- Certificate of Coverage

- Policy Wording

While this document may seem lengthy and a bit daunting (yes, it really does look and read like a contract!), it’s important to read through the benefit descriptions to make sure you understand how the benefits are applied. After all, this is the document that the insurance company uses to process your claims.

To learn more about other out of pocket expenses that may come up on your insurance plan, read our Understanding Out of Pocket Expenses article.

4 Tips for an Easy Insurance Waiver Process

March 21st, 2016 by Sutherland Beever

Finding an insurance policy that meets both your personal and school qualifications can be tough. Luckily the waiver process is easy.

Waivers 101

It is common for colleges and universities in the U.S. to allow their international students to “waive” a school-sponsored health insurance plan, and instead purchase a plan of their own choosing – provided that it meets a list of school-mandated requirements.

In order to prove to your school that you’ve purchased an insurance plan meeting their guidelines, your school may require that you complete a waiver form. Of course all waiver forms are different, but typically includes the following:

- A student section, requiring your name, date of birth and signature

- A list of benefits that your alternative plan must include, such as coverage for sports, maternity and mental health

- The specific dates that your insurance coverage needs to be active

- A section to be completed by the insurance company, which typically requires a signature and date

For reference, these waiver forms tend to be between 1-2 pages long and can be downloaded from your school’s website, or provided from the health services or international office on campus.

Now that you know what a waiver is and what it’s used for, let’s get into our 4 tips for an easy insurance waiver process!

Tip 1: Start Early!

The trick to getting your waiver completed and back to your school on time is simply starting the process as quickly as possible. After you’ve taken the time to track down a plan that meet your school requirements, it’s important to keep in mind that sections of your waiver form may need to also be completed by the insurance company. For reference, this process generally takes between 2-3 business days (meaning that weekends don’t count!), so don’t forget to add in a few extra days when creating a timeline for your waiver form.

Read Your Waiver Carefully!

Before you begin the search for your insurance plan, be sure to read and re-read your waiver requirements. Oftentimes schools won’t accept your waiver if it’s overdue, or if every requirement isn’t met, so knowing what your school will accept ahead of time can make a huge difference!

Tip 3: Don’t Forget to Sign!

The majority of waivers aren’t complete without your signature! Oftentimes waivers have a section for the insurance company to complete as well as a student portion – which requires your name, insurance policy number, as well as your date of birth and of course, your autograph. Keep in mind that the form can’t be completed until the ‘student portion’ of your waiver is filled out, so be sure to include your signature to avoid delays.

Tip 4: When in Doubt, Ask for Help!

We know first-hand how confusing health insurance terminology can be, so when in doubt, contact us! Our licensed health insurance agents can help you find the best plan for your budget and can help confirm which of our plans will best meet your school requirements. It’s also important to remember that simply buying a plan that your school will accept isn’t nearly as important as knowing how to use your insurance in case you need it. We’re available Monday through Friday to help answer your insurance questions, find a doctor that will accept your plan, and explain your out of pocket expenses.

Now that you’re armed with these helpful tips, be sure to find a plan that meets all of your insurance waiver requirements, and don’t hesitate to contact us for help.

Why you Need an International Student Insurance Plan you can Renew

February 23rd, 2016 by Bryanna Davis

If you’re like many other international students who come to the US to study, you’ll be pursuing your degree for a few years. In turn, this also means you will need a health insurance plan that you can keep during that time. While it might initially seem like a good idea to purchase a health insurance plan for a few months or maybe just one year to “test it out,” this can cause a few problems down the line- especially if you have a condition that develops while on your plan- or if you come to the United States with a pre-existing condition.

Before we go into why this could cause a few problems, first, it’s key to understand what a pre-existing condition is. A pre-existing condition is defined differently by each insurance company, and the look back period (a specific time period prior to having the insurance plan) can vary depending on the plan. Be sure to check your insurance plan, but generally the definition may include some form of the following:

“Any injury or illness which, within the 365 days prior to the effective date of coverage, manifested itself, exhibited symptoms, or required medical treatment or medication, or for which a physician was consulted.”

Many short term plans will not cover pre-existing conditions, and if they do, they might have a waiting period (period in which you must be on the plan before you’re able to have coverage for a specific condition) or look back period (like the example above). So although taking the risk of having your health insurance plan terminate after the first year might not seem like a big deal, it can be if you have a medical condition that you need continuing treatment for.

Pre-Existing Condition Example

To explain this, here is a common scenario: Let’s say you purchase a plan that has a six-month waiting period before pre-existing conditions are covered, and that the plan cannot be renewed beyond one year. You, however, decide to purchase the plan for one year, as you can still purchase a new plan after one year if you need further coverage.

Here are two potential outcomes that could cause you to worry:

You Develop A Condition While on your Plan:

In the hustle and bustle of studying in a new country, the year quickly goes by and your insurance plan ends. This wouldn’t be a problem had you not used the plan, but last week you discovered you have asthma- and now you need to go to the doctor a multiple times over the next few months. Since your plan has ended you will need to buy a new insurance, and your asthma will now be considered a pre-existing condition and not covered within the first six months. This means that your doctor appointments, medication, and any labs for your asthma will not be covered, and you will need to pay for them out of pocket. On the contrary, if you had purchased a plan that was renewable, you could have simply renewed your plan for an additional year and your asthma condition would continue to be covered.

Since accidents do happen, it’s important to ensure that the plan you purchase is able to be extended and renewed for the entire time you will be in the US so you don’t risk running into this situation.

You Need Coverage for a Condition you had Prior to the Plan Starting:

As mentioned previously, if you have a medical condition before your plan begins it will be considered a pre-existing condition. This means that your plan must include coverage for pre-existing conditions (and the condition you need treatment for) in order for that condition to be covered. For example, if you come to the US with epilepsy and purchase a plan with a six month waiting period for pre-existing conditions, it will be a six month wait before that condition will be covered. After that six month period you would then be able to have coverage for your pre-existing condition. However, if your plan does not allow you to renew, you would then need to buy a new plan and go through the waiting period again.

If you would like an international student health insurance plan that can be renewed for up to four years check out the Student Secure plan.

Additionally, keep in mind that if you’ve had an alternative plan in the past without a condition arising then buying a new plan is perfectly fine and you won’t have to worry about pre-existing condition coverage at all!

If you need coverage for a pre-existing condition right away you might want to consider looking into whether you’re eligible for an ACA-compliant plan. However, keep in mind that ACA compliant plans will not provide you with certain benefits that international students and scholars need like emergency medical evacuation and repatriation of remains.

New Provider Network in 2016

January 21st, 2016 by Ross Mason Effective 1st January 2016, the provider network for our main Student Health and Travel Medical insurance plans will be changing to the First Health Network. This is a welcomed move, as the First Health Network provides a much wider choice and greatly improves your access to participating providers.

Effective 1st January 2016, the provider network for our main Student Health and Travel Medical insurance plans will be changing to the First Health Network. This is a welcomed move, as the First Health Network provides a much wider choice and greatly improves your access to participating providers.

Download New ID Card

You should have already received an email letting you know about this change, but just to remind you as part of the change, you will need to discard your current insurance ID card and log into the Student Zone to download your new ID card with the new network logo:

http://www.internationalstudentinsurance.com/student-zone/

Benefits of the First Health Network

Through the network, you will now have access to:

- More than 5,000 hospitals

- Over 90,000 ancillary facilities

- Over 1 million health care professional service locations

- Over 98% of the U.S. population has access to a provider in our network

- Improved search functionality with a fully mobile-optimized search

The new link to search for providers is:

http://www.internationalstudentinsurance.com/network/

(The link in your student zone has also been automatically updated)

Thank you for your understanding and please do not hesitate to contact us if you have any questions.

Terrorism Coverage Explained

December 22nd, 2015 by Sutherland Beever With the recent attacks in Paris, the topic of terrorism has quickly transitioned from the back burner of international news to the front page of newspapers worldwide. While the rest of the world has turned its focus to the perpetrators and the healing process following this malicious act, our team at International Student Insurance wants to make sure you are safe and covered no matter where your travels take you. In today’s blog, we are going to discuss the terrorism benefit on many travel plans including what it covers and how travel warnings affect coverage.

With the recent attacks in Paris, the topic of terrorism has quickly transitioned from the back burner of international news to the front page of newspapers worldwide. While the rest of the world has turned its focus to the perpetrators and the healing process following this malicious act, our team at International Student Insurance wants to make sure you are safe and covered no matter where your travels take you. In today’s blog, we are going to discuss the terrorism benefit on many travel plans including what it covers and how travel warnings affect coverage.

Terrorism Coverage 101

Generally speaking, terrorism coverage is a benefit included in many international travel insurance plans, providing protection in the event of an unforeseen terrorist attack. The terrorism benefit is designed to pay for injuries and illnesses that result from acts of terrorism, including necessary hospitalizations, doctor visits, prescriptions, and other medical treatment required for ongoing care.

In order to file a claim under the terrorism benefit, several conditions must be met. To find these conditions, it’s important to turn to your Description of Coverage, or Certificate, to see how it’s defined on your insurance plan. As an example, points 1-4 below are taken from the Atlas Travel plan’s 2015 Description of Coverage.

In order to qualify for terrorism coverage on the Atlas Travel plan, the following conditions must be met:

- The Injury or Illness does not result from the use of any biological, chemical, radioactive or nuclear agent, material, device or weapon; and

- The Member has no direct or indirect involvement in the Act of Terrorism; and

- The Act of Terrorism is not in a country or location where the United States government has issued a travel warning that has been in effect within the 6 months immediately prior to the Member’s date of arrival; and

- The Member has not failed to depart a country or location within 10 days following the date a warning to leave that country or location is issued by the United States government.

The majority of these points may seem quite straightforward – you won’t be covered in the event of a nuclear war and you can’t be personally involved in the terrorist attack. But what about points 3 and 4? If you are wondering if you’ll be eligible for the terrorism benefit, you will need to review the plan wording closely. Oftentimes the terrorism benefit is removed if a travel warning has been in place as early as 6 months before your date of departure.

To determine if this will affect you, you will need to know what travel warnings are and how you can find out if there is a travel warning in your destination country.

Travel Warnings 101

Travel warnings in the US are issued by the Department of State, Bureau of Consular Affairs to warn travelers about the risks of traveling to certain areas where there is unrest or explicit danger to travelers. These travel warnings remain in place until the situation improves, and depending on the country, some of these warning have been in effect for many years. These travel advisories can be issued for a variety of reasons, including ongoing and intense crimes, violence, unstable governments, terrorist attacks, or civil war. Here’s how travel warnings can affect your benefits:

What if there is a travel warning before I arrive?

Your international insurance company monitors travel warnings, and in many cases, once a travel warning has been issued within the past 6 months of your plan’s effective date, the terrorism benefit will be considered null and void.

What if there is a travel warning and I’m already in my destination country?

In the unforeseen event that a travel warning is issued for your current location after you’ve arrived, your insurance plans will still provide terrorism coverage unless you unreasonably fail or refuse to follow the travel warning issued. If you choose to voluntarily stay in that given area, it’s likely that the terrorism benefit will be removed.

If you are unsure about your coverage, be sure to review your policy wording or contact your insurance carrier to verify how coverage may be affected.

Where Can I Find Travel Warnings?

It’s important to keep up to date with the travel warnings well before your flight leaves and throughout your trip to ensure that your safe. While local and national media channels are a great way to keep up with the local news, one of the best ways to keep up is to enroll in the STEP program through the Department of State. This free service allows US citizens and nationals to get important up to date information on safety concerns by local Consulates and Embassies.

In the event that an act of terrorism has occurred, your insurance company will typically reach out to you directly or post relevant information on the attack on their company website, or other online portal, such as a Student Zone.

Terrorism coverage can be seen as an additional and unnecessary benefit hidden near the bottom of a table of benefits – but just as Paris didn’t see an attack coming, terrorism is rarely predictable. If you have any questions about how a terrorist attack could affect your travel insurance plan or if you are looking to purchase a plan with terrorism coverage, contact a licensed health insurance agent for help.

2015 InternationalStudent.com Travel Video Contest Winners!

November 23rd, 2015 by Sutherland Beever It was a very close call, but after much deliberation the winners of the 2015 InternationalStudent.com Travel Video Contest have been announced!

It was a very close call, but after much deliberation the winners of the 2015 InternationalStudent.com Travel Video Contest have been announced!

With so many fantastic submissions from both current and aspiring international students from around the globe, the Contests 10th anniversary was an overwhelming success. After narrowing the competition down to just 14 Finalists, an elite team of judges ranked each video based on its originality, creativity, and overall quality to choose the Contest winners.

Now what were these students competing for, you may ask? Besides world-wide fame of course, InternationalStudent.com provides nearly $6,000 in prizes and the overall winner also receives their own blog to document their international adventures.

And now, the moment you’ve been waiting for!

A big round of applause and a huge congratulations to Amar Chaniago, the first place winner of the 2015 Travel Video Contest! His submission, “My Second Chance at Life” tells the inspiring story of a young student whose life was changed forever by an automobile accident. Instead of losing faith he chose to make the most out of his second chance at life and spend a large portion of his time traveling the world. Along with his well earned $4,000 prize, Amar will also be given his very own blog on InternationalStudent.com to document his travels, thoughts and experiences abroad.

Bringing home the second place prize of $500 is Michelle Leclercq for her inspiring video, “Place Yourself Where You Want to Be.” Bravely choosing to leave her home country behind in pursuit of her true passion, Michelle toured the United States with little more than an acoustic guitar, soaking in the sights and sounds of an unfamiliar culture.

The third place winner and a big congratulation goes to Léa Kriger-Bécourt for her video “The Missing Piece.” As one of the more creative submissions of this year’s Contest, Léa’s video was comprised of hand-drawn pictures on a jigsaw puzzle, perfectly illustrating her interests, goals, and future endeavors. Her appropriately titled film has won Léa a prize of $250!

Last but certainly not least is the Viewer’s Choice award winner, Murtaza Ibrahimi. Earning $1,000 to put towards his education, “Flowers of Success” tells a story of passion and pure dedication to the country of Afghanistan. This year’s fan favorite, Murtaza hopes to better the lives of his fellow citizens through the power of music and continues to work diligently to improve his own life and the life of those around him.

We would like to wish a big thank you to everyone who participated in our Contest, and to each of the winners! Remember the Contest will be back next year, so keep a look out on InternationalStudent.com for next year’s Contest details and deadlines.

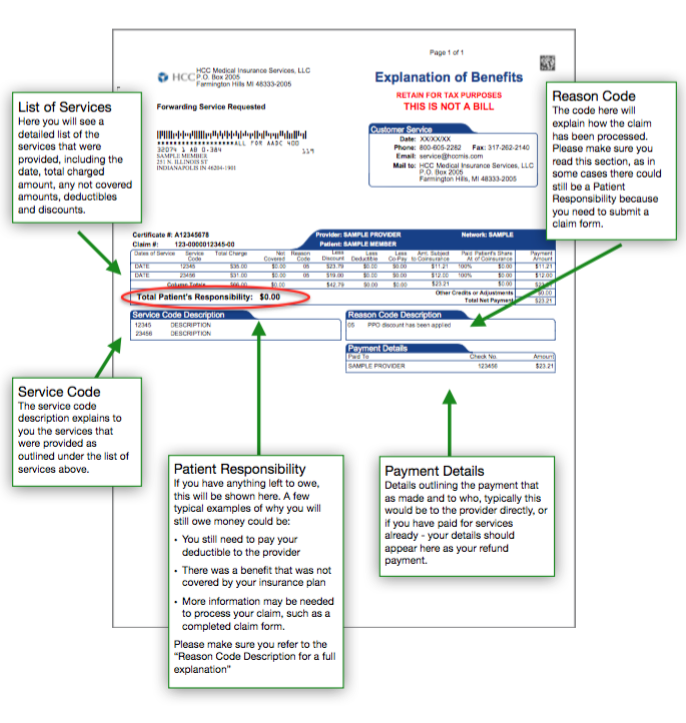

Understanding Your Explanation of Benefits (EOB)

November 16th, 2015 by Ross Mason When a claim has been processed by your insurance company, you will most likely receive an explanation of benefits – or for short an EOB. This document will outline to you what charges were received and reviewed by your insurance company, and what action was taken. In most cases the EOB will list out all those charges that were received, what they were for, what was paid or denied and the reasons behind those actions.

When a claim has been processed by your insurance company, you will most likely receive an explanation of benefits – or for short an EOB. This document will outline to you what charges were received and reviewed by your insurance company, and what action was taken. In most cases the EOB will list out all those charges that were received, what they were for, what was paid or denied and the reasons behind those actions.

Like many international students, and even seasoned professionals like ourselves, EOB’s can sometimes be a little tricky to understand at first glance. However nearly in every case, it takes just a few minutes to read the EOB more carefully, and to look out for certain items – and the EOB is no longer as confusing!

This blog post is designed to guide you through the EOB maze, so you know what to look out for and how to read them.

How do I receive my EOB?

The method in which your EOB is delivered to you will vary from one insurance company to another. However, you will want to try and make sure these are delivered electronically – either through an online portal or via email. This will be the quickest and simplest method, because if you are only abroad for a few months and the EOB is mailed to you – in many cases you might not even receive it. So its pretty important to make sure your insurance company can email or deliver your EOB electronically. If they can’t do that, make sure you update your address on file. If you do not receive your insurance EOB’s, and they are informing you to complete a claim form and that is not received, the claim will be closed and you will have to pay all those expenses.

What does an EOB look like?

EOB’s vary in their format from insurer-to-insurer, but in most cases they include very similar information just in a different format. When you purchase one of our main Student Health or Travel Medical insurance plans, your EOB’s will be available electronically through MESA in your Student Zone and they will look like this:

Important EOB Sections

There are a number of line items and sections to most EOB’s, in the example above the main items you need to look for – and pay attention to are:

List of Services

In this section, you should see a list of all services that were provided and billed to your insurance company, along with full details about what expenses were not covered, those that were discounted, those that were applied to deductibles or coinsurance and then finally any amount that was paid out. It is important to note here that often times one trip to the hospital might have multiple charges from the actual hospital, from the attending doctor, etc… so do not be concerned with many line items listed here.

Service Code

The service code highlights the services that were performed, providing you with more description about the actual work that service relates to. In some cases, EOB’s might have a listing of number and codes on the back of the EOB for you to look up. In our example, the EOB lists this on the front of the document.

Reason Code

The reason code is a very important section to look for, as this highlights how the claim has been processed. For example if the claim was denied then it would be listed here in the reason code, likewise if the claim has not been paid because the claims team need a completed claim form – this will also be listed here.

Patient Responsibility

This section will show what you still need to pay the medical provider. It is important to note that even though your claim has been approved and accepted, you could still have a patient responsibility that you owe to the provider that treated you, such as a deductible or coinsurance. A patient responsibility does not necessarily mean your claim has been denied, so it is very important to cross reference this with reason code to check on how the claim was processed.

Payment Details

This very simply outlines what has been paid and to whom.

Of course, if you have any questions about Understanding Your Explanation of Benefits (EOB) through one of our plans – please do not hesitate to contact our team who will be happy to help you understand how your claims were processed!

Medical Evacuation and Repatriation: Why It Matters

October 29th, 2015 by Jennifer Frankel It’s 2 in the morning, and you can’t breathe! You are rushed to the hospital, and they need to send you to another city to get medical treatment. What do you do? In an emergency situation like this, it’s important that you pre-plan and have an insurance plan that will cover you in case the care you need is not available locally. This benefit is typically referred to as emergency medical evacuation and repatriation. Every international student and scholar – along with their dependents – should have a plan that covers this. In today’s blog, we will talk about what these benefits are, why you need it, and how you can find an insurance plan with these benefits.

It’s 2 in the morning, and you can’t breathe! You are rushed to the hospital, and they need to send you to another city to get medical treatment. What do you do? In an emergency situation like this, it’s important that you pre-plan and have an insurance plan that will cover you in case the care you need is not available locally. This benefit is typically referred to as emergency medical evacuation and repatriation. Every international student and scholar – along with their dependents – should have a plan that covers this. In today’s blog, we will talk about what these benefits are, why you need it, and how you can find an insurance plan with these benefits.

What is Medical Evacuation and Repatriation of Remains?

Both medical evacuation and repatriation are designed to cover the transportation costs of a major emergency or death, and are typically coordinated by the insurance company.

Emergency medical evacuation transports you to the nearest facility equipped to handle treatment. This could mean another city, country, or even your home country. The facility where you would be transported is generally based on your overseeing doctor, and they work in collaboration with the insurance company to make sure you receive the care you need.

Repatriation of remains, also referred to on some insurance plans as Return of Mortal Remains, will transport the body back to the home country in case of death. Like medical evacuation, the insurance company typically coordinates the transportation behind the scenes.

These benefits are typically included in international plans and are not generally included on local domestic plans, but you never know! The only way to be sure is to check your policy certificate to see whether these benefits are included.

Why Do I Need This?

If you will be studying outside your home country, it’s very important to have these two benefits in place just in case you need care elsewhere. Here are just a few reasons why:

- It’s expensive. The average cost of a medical evacuation will depend on the type of treatment needed, accommodations to keep the person stable, and where they are being transported to and from. According to Travelex, the average medical evacuation can cost upwards of $25,000 and repatriation of remains can cost upwards of $11,000.

- Help with coordination. If someone is gravely sick or injured, they are not going to be able to coordinate their own transportation! Having an insurance plan that covers this means that they will also help coordinate the transportation. The insurance company not only works with all parties involved, but they usually have a case manager with expertise on handling the logistics to ensure that everything goes smoothly.

- Loved ones. There is nothing more difficult than having a family or friend who has a major medical issue, and there is no one there to help. Having an insurance plan with these benefits means that their loved ones can rest assured that the sick is being taken care of, and the insurance company will provide them updates on the status as the evacuation progresses.

Your Insurance Plan

Your Insurance Requirements

Because of the importance of medical evacuation and repatriation of remains, there are many requirements mandating this type of coverage. J1 visa holders and their dependents are required to have at least $25,000 for repatriation of remains and $50,000 for medical evacuation according to the Department of State. While F and M visa holders are not mandated to have insurance by the Department of State, the school will typically require students to have a certain level of coverage, often times requiring students to have coverage for both.

How To Comply

As an international student or scholar, you are more than likely required to have emergency medical evacuation and repatriation of remains coverage during the entire time you are in the US. If you have a dependent with you, they are likely required to have it as well. There are two ways to get coverage with these benefits:

1. Your health insurance includes medical evacuation/repatriation – If you have an international health insurance plan, you are more than likely going to have a plan which includes this coverage. Be sure to call your insurance company or check your policy certificate to verify that you 1) have insurance for these two benefits (they are usually listed separately) and 2) have sufficient coverage to meet the requirements listed by the Department of State or your school. If you have dependents with you, make sure they are covered as well! Some group plans do not cover dependents, but that doesn’t mean they don’t need it. If you or your dependents don’t have an insurance plan in place, you can purchase an individual plan that will include these benefits. >>Learn about the Student Secure plan (for students) and the Travel Medical (for dependents).

2. Your health insurance does not have medical evacuation/repatriation – If you have a domestic plan, chances are that your plan does not include coverage for medical evacuation or repatriation, since it was not designed with international students in mind. If you or your dependents have an Affordable Care Act compliant plan, for example, then it’s unlikely that it will cover these two benefits. If that’s the case, there are standalone plans that can be purchased with those two benefits – and the coverage will also meet the J visa requirements! >> Learn more about the Medical Evac plan to buy a standalone plan.